Understanding mortgage rates is crucial for anyone considering homeownership. Mortgage rates directly impact the overall cost of your home loan and your monthly payments. This comprehensive guide aims to demystify the complexities of mortgage rates, providing you with the essential knowledge needed to navigate the home-buying process with confidence. We’ll explore the factors influencing mortgage rates, different mortgage rate types (such as fixed-rate mortgages and adjustable-rate mortgages), and strategies for securing the most favorable mortgage rate possible. Whether you’re a first-time homebuyer or a seasoned homeowner looking to refinance, understanding the nuances of mortgage rates is paramount.

This guide will equip you with the tools to compare mortgage rates effectively, understand the relationship between mortgage rates and Annual Percentage Rate (APR), and make informed decisions about your home financing. By exploring the various mortgage rate options available, you can determine the best fit for your financial situation and long-term goals. Learn how mortgage rates are influenced by economic factors, credit scores, loan terms, and down payment amounts. With a clear understanding of mortgage rates, you’ll be empowered to make sound financial choices and secure the home of your dreams.

What Influences Mortgage Rates?

Several factors play a crucial role in determining mortgage rates. Understanding these influences can help you make informed decisions when securing a home loan. Economic conditions, such as inflation and unemployment, significantly impact rates. A strong economy often leads to higher rates, while a weaker economy may result in lower rates.

The Federal Reserve’s monetary policy also plays a key role. When the Federal Reserve raises the federal funds rate, mortgage rates tend to increase. Conversely, when the federal funds rate decreases, mortgage rates often follow suit.

Investor demand for mortgage-backed securities is another important factor. High demand for these securities can drive down mortgage rates, while low demand can push them higher.

Finally, your individual credit score and the type of loan you choose (e.g., fixed-rate, adjustable-rate, FHA, VA) also impact the interest rate offered by lenders.

Fixed vs. Adjustable Rate Mortgages

Choosing between a fixed-rate and an adjustable-rate mortgage (ARM) is a crucial decision in the home-buying process. With a fixed-rate mortgage, the interest rate remains constant throughout the loan term, resulting in predictable monthly payments. This stability makes budgeting easier and protects borrowers from potential interest rate hikes.

In contrast, an adjustable-rate mortgage (ARM) features an interest rate that fluctuates based on market conditions. ARMs typically start with a lower initial interest rate than fixed-rate mortgages. However, this rate can adjust periodically, leading to potentially higher or lower monthly payments. This makes budgeting more complex and introduces an element of risk.

How to Compare Mortgage Offers

Comparing mortgage offers is crucial to securing the best possible loan terms. Focus on key factors to make an informed decision. Interest rate is a primary driver of your monthly payment. A lower rate translates to lower costs over the life of the loan.

Loan type also plays a significant role. Fixed-rate mortgages provide payment stability, while adjustable-rate mortgages (ARMs) offer potentially lower initial rates but fluctuate over time. Consider your risk tolerance.

Fees and closing costs add to the overall loan expense. Compare lender fees, including origination charges, appraisal fees, and other closing costs. Loan term influences both your monthly payment and total interest paid. Shorter terms have higher payments but lower overall interest.

The Importance of Credit Scores

Your credit score plays a crucial role in determining your mortgage rate. Lenders use your credit score to assess your creditworthiness, or how likely you are to repay your loan.

A higher credit score generally translates to a lower interest rate. This is because lenders view borrowers with high credit scores as lower risk. A lower interest rate can save you thousands of dollars over the life of your loan.

Conversely, a lower credit score typically results in a higher interest rate. Lenders perceive borrowers with lower credit scores as higher risk and charge more to compensate for that risk.

Locking In a Mortgage Rate

Once you’ve chosen a lender and received a loan estimate, you can lock in your interest rate. This guarantees a specific rate for a set period, typically 30 to 60 days, sometimes longer. This protects you from potential rate increases while you finalize your mortgage.

Locking in means your rate won’t change even if market rates fluctuate. However, if rates fall, you won’t benefit unless you have a float-down option. This option, if available, allows you to secure a lower rate if market rates decrease before closing.

Consider the closing timeline when deciding when to lock. A longer lock period may be necessary for complex transactions. Be aware that longer lock periods may come with a slightly higher rate. Discuss the pros and cons of different lock periods with your lender to make an informed decision.

Understanding Closing Costs

Closing costs are expenses beyond the property’s price that buyers and sellers pay to finalize a real estate transaction. These costs are typically due at closing, the final step in the home buying process.

Common closing costs for buyers include:

- Loan origination fees

- Appraisal fees

- Title insurance

- Escrow fees

- Prepaid taxes and insurance

These costs can vary depending on the loan amount, the lender, and the location of the property. It’s important to factor these costs into your budget when considering purchasing a home.

Mortgage Rate Trends and Forecasts

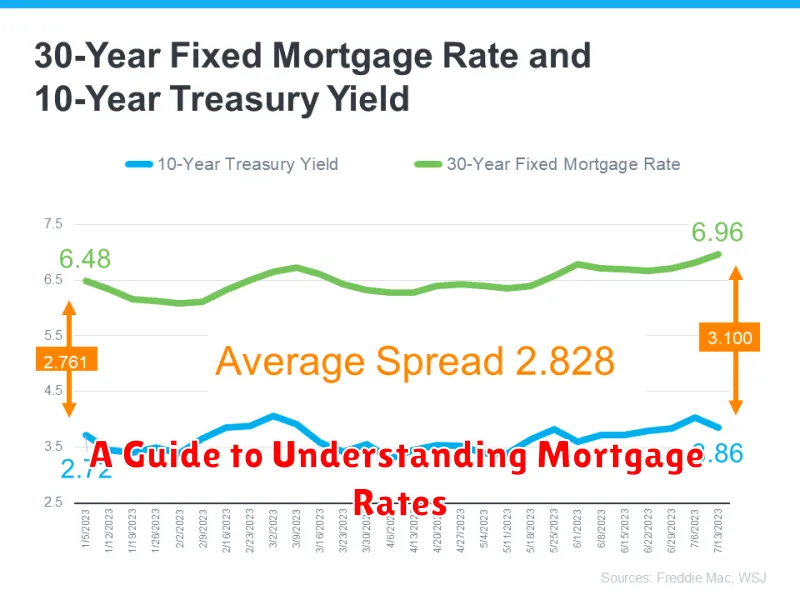

Understanding current mortgage rate trends is crucial for making informed home-buying decisions. Several factors influence these trends, including economic growth, inflation, and the actions of the Federal Reserve. Fluctuations in these indicators can cause rates to rise or fall, impacting affordability for potential homebuyers.

Forecasting mortgage rates is complex and involves analyzing various economic data points. While predicting future rates with certainty is impossible, experts analyze trends and make informed projections. These forecasts can provide a general outlook but should not be considered definitive. Borrowers should be prepared for potential changes and factor in a range of possibilities when planning their budgets.

Negotiating Better Mortgage Terms

While mortgage rates are often influenced by market factors, some terms are negotiable. This can lead to significant savings over the life of the loan. Proactive negotiation is key to securing the best possible terms for your individual circumstances.

Key negotiable aspects can include:

- Interest rate: Don’t be afraid to ask for a lower rate, especially if you have a strong credit score and a healthy financial profile.

- Closing costs: Negotiate for lower closing costs or ask the lender to cover a portion of these expenses.

- Loan origination fees: These fees are charged by the lender for processing the loan. They can often be negotiated lower.

- Discount points: Paying discount points upfront can lower your interest rate, but carefully consider if this is beneficial for your long-term goals.

Preparation is essential. Shop around and compare offers from multiple lenders. This provides leverage during negotiations. Be prepared to provide supporting documentation, like proof of income and assets. A clear understanding of your financial standing strengthens your negotiating position.

Refinancing to Secure Lower Rates

Refinancing your mortgage involves replacing your existing loan with a new one, often to secure a lower interest rate. This can significantly reduce your monthly payments and overall interest paid over the life of the loan. Carefully evaluate the closing costs associated with refinancing to ensure the potential savings outweigh the expenses.

Several factors influence whether refinancing is beneficial. These include the difference between your current rate and available rates, the remaining term of your loan, and how long you plan to stay in your home. A significant difference in interest rates is often the primary motivator for refinancing.

Preparing Financially for a Mortgage

Securing a mortgage requires careful financial preparation. Credit score plays a vital role; a higher score often translates to better interest rates. Review your credit report for errors and address any outstanding issues to improve your score.

Saving for a down payment is crucial. A larger down payment can reduce your loan amount and potentially lower your monthly payments. Lenders also assess your debt-to-income ratio. Lowering existing debt can improve your chances of approval and potentially secure a more favorable interest rate.