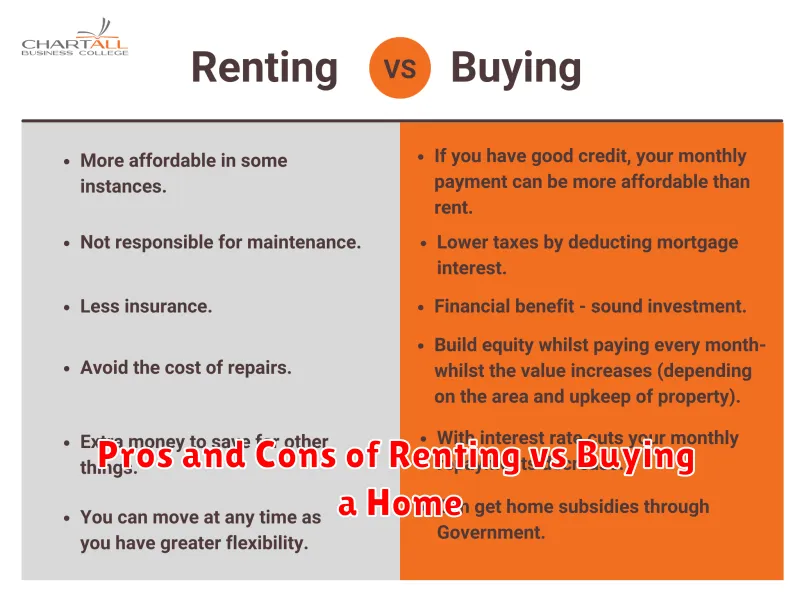

The age-old question of whether to rent or buy a home is a significant financial decision with long-term implications. This comprehensive guide explores the pros and cons of renting versus buying, offering valuable insights to help you make the best choice for your individual circumstances. Understanding the advantages and disadvantages of both renting and buying is crucial for navigating the complex real estate landscape. Factors such as your financial stability, lifestyle preferences, and long-term goals play a key role in determining whether renting a home or buying a home is the right path for you.

Weighing the pros and cons of renting vs. buying requires careful consideration of various factors. From the flexibility of renting to the potential investment benefits of owning a home, each option presents its own set of advantages and disadvantages. This article will delve into the specifics of each, analyzing the financial implications, lifestyle considerations, and long-term benefits associated with renting and buying. By exploring the pros and cons of each option, you will be empowered to make an informed decision that aligns with your personal and financial objectives.

Flexibility and Commitment

Renting offers greater flexibility. Lease terms are typically shorter, allowing renters to move more easily for job changes, lifestyle preferences, or other reasons. There’s less commitment to a specific location.

Buying a home, conversely, represents a significant commitment. Mortgages are long-term obligations, and selling a home can be a complex and time-consuming process. However, this commitment can also foster a sense of stability and belonging within a community.

Financial Benefits of Ownership

Owning a home offers several key financial advantages. Building equity is a primary benefit. As you pay down your mortgage, you gradually own a larger portion of your property, accumulating wealth over time.

Tax deductions are another potential perk. In some regions, homeowners can deduct mortgage interest and property taxes, lowering their overall tax burden.

Finally, a fixed-rate mortgage provides predictable housing costs. Unlike rent, which can fluctuate with market conditions, your mortgage payment remains stable, offering long-term budget stability.

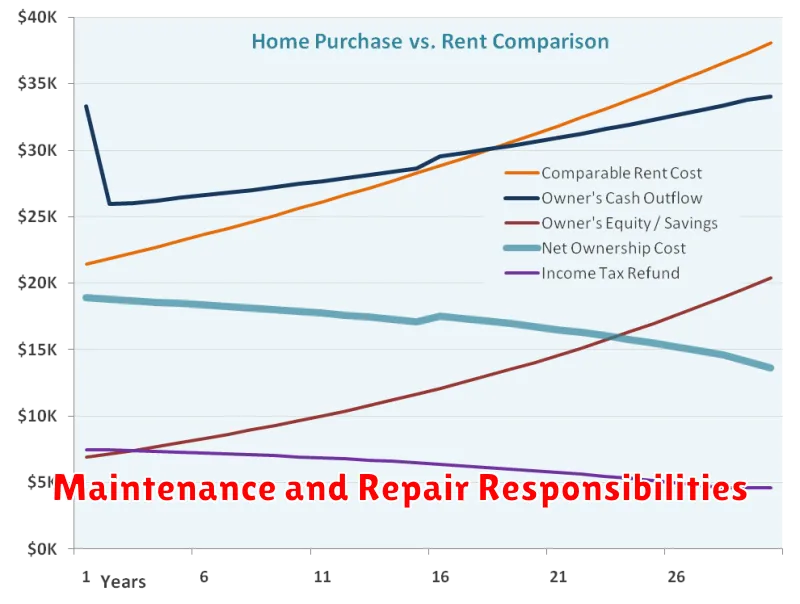

Maintenance and Repair Responsibilities

A key difference between renting and buying lies in maintenance and repair responsibilities. Renters typically enjoy a hands-off approach, with landlords responsible for most repairs. This means less financial burden and fewer time commitments for tenants.

Homeowners, conversely, shoulder the full responsibility for upkeep and repairs. This includes everything from routine maintenance like landscaping and appliance upkeep to major repairs such as roof replacements or plumbing issues. While this can be a significant financial and time commitment, it also grants homeowners greater control and customization options for their living space.

Property Appreciation Potential

A significant advantage of homeownership is the potential for property appreciation. Over time, real estate values tend to increase, allowing homeowners to build equity. This accumulated equity can be a valuable financial asset, acting as a forced savings plan and potentially providing a substantial return on investment when the property is sold.

While renting provides no such benefit, fluctuations in the housing market can influence appreciation rates. Factors such as location, property condition, and market trends play a crucial role in determining the potential for appreciation.

Initial Costs Comparison

When considering renting versus buying, a crucial factor is the initial cost outlay. Renting typically requires a security deposit and first month’s rent. Buying a home involves significantly higher upfront costs, including a down payment, closing costs, and potentially prepaid expenses like property taxes and homeowner’s insurance.

The down payment, often a percentage of the purchase price, can be a substantial sum. Closing costs encompass various fees associated with the transaction, such as appraisal and loan origination fees. These initial expenses are typically much lower for renters than for buyers.

Tax Benefits of Homeownership

One of the most significant financial advantages of owning a home are the potential tax deductions. Mortgage interest and property taxes are often deductible, which can significantly reduce your taxable income. This can result in substantial tax savings, especially in the early years of your mortgage when interest payments are higher.

Additionally, you may be able to deduct certain other homeownership-related expenses like points paid at closing and private mortgage insurance (PMI) premiums, subject to specific income limitations and loan requirements. It’s important to consult with a tax professional to determine your eligibility and maximize your potential tax benefits.

Lifestyle Considerations

Beyond the financial aspects, your lifestyle plays a crucial role in deciding between renting and buying. Renting offers flexibility. You can easily relocate when your lease is up, making it ideal for those with dynamic careers or a desire to explore different areas. Maintenance and repairs are typically the landlord’s responsibility, freeing up your time and reducing unexpected expenses.

Homeownership, conversely, provides stability and the opportunity for personalization. You have the freedom to renovate, decorate, and truly make the space your own. Building equity and the potential for property appreciation are long-term benefits that contribute to a sense of security and investment in your future. However, homeowners are responsible for all maintenance and repair costs, demanding both time and financial resources.

Evaluating Market Conditions

Market conditions play a crucial role in deciding whether to rent or buy. A buyer’s market, characterized by lower prices and more inventory, favors purchasing. Conversely, a seller’s market, with high prices and limited inventory, might make renting more attractive.

Consider interest rates. Lower rates reduce borrowing costs, making homeownership more affordable. Higher rates increase monthly mortgage payments, potentially making renting a more financially sound option.

Analyze inventory levels. A high inventory suggests greater negotiating power for buyers, while low inventory can lead to bidding wars and inflated prices. Evaluate the local market trends in your desired area to make an informed decision.

Understanding Equity and Wealth Building

A key difference between renting and buying lies in the potential for wealth building. Renting provides housing but doesn’t contribute directly to long-term financial growth. Buying a home, however, allows you to build equity.

Equity is the portion of your home that you actually own. It increases as you pay down your mortgage and as your property value appreciates. This growth in equity represents a significant wealth-building opportunity.

Think of it like forced savings. With each mortgage payment, you’re putting money towards an asset that can increase in value over time. This accumulating equity can be accessed later through refinancing or selling the property, providing financial security for the future.

Choosing the Best Option for Your Situation

Determining whether to rent or buy depends heavily on individual circumstances. There is no universally “better” choice.

Financial stability plays a crucial role. Buying a home requires a significant upfront investment, including a down payment and closing costs. Renting typically requires a lower initial financial commitment.

Your time horizon is another key factor. If you anticipate relocating within a few years, renting offers greater flexibility. Longer-term plans may make homeownership more appealing, allowing you to build equity over time.

Finally, consider your lifestyle preferences. Homeownership involves maintenance responsibilities, while renting provides freedom from these tasks. Weigh these factors carefully to make the best choice for your specific needs.