Investing in real estate can be a lucrative venture, offering both financial security and long-term growth. However, navigating the complex world of property investment requires careful consideration of various key factors. Understanding these crucial elements is paramount to making informed decisions and maximizing your return on investment (ROI). This article will explore the essential aspects to consider before investing in real estate, providing valuable insights for both novice and experienced investors. From analyzing market trends and property values to assessing financing options and legal considerations, we’ll delve into the key factors that contribute to successful real estate investments.

Whether you’re considering residential properties, commercial real estate, or land development, due diligence is essential. We’ll examine key factors such as location, property condition, potential rental income, and future development prospects. By understanding these critical components, you can mitigate risks, identify profitable opportunities, and confidently embark on your real estate investment journey. This guide will empower you with the knowledge to make sound investment choices, paving the way for a secure and prosperous financial future through strategic real estate acquisitions.

Location and Neighborhood Analysis

Location plays a crucial role in real estate investment. A desirable location often translates to higher property values and rental income.

Conduct thorough neighborhood analysis. Consider factors like:

- Crime rates: Lower crime rates contribute to a safer environment and increased property desirability.

- School districts: Proximity to good schools can significantly impact property values.

- Amenities: Access to shops, restaurants, parks, and transportation adds value and attracts tenants or buyers.

- Job market: A strong local economy with ample job opportunities often leads to population growth and housing demand.

Evaluate the neighborhood’s future potential. Look for signs of development and growth that can further increase your investment’s value over time.

Market Growth Potential

A crucial aspect of real estate investment is analyzing the potential for market growth. Appreciation, the increase in property value over time, is a primary driver of returns. Several factors influence market growth potential.

Economic growth in the area stimulates demand and drives up prices. Consider factors like job growth, population increase, and infrastructure development. Supply and demand dynamics also play a significant role. Limited supply coupled with high demand creates a competitive market, boosting property values.

Local government policies, such as zoning regulations and tax incentives, can impact market growth. Favorable policies can attract investment and stimulate development, while restrictive policies can hinder growth. Analyzing these factors helps investors identify markets with strong potential for future appreciation and higher returns.

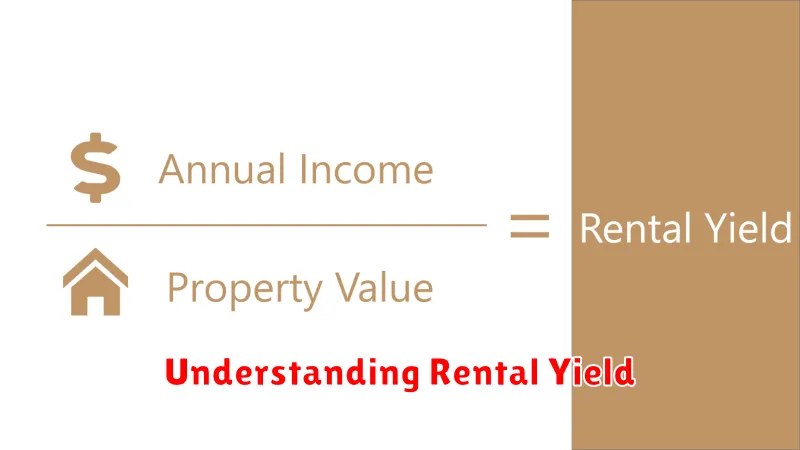

Understanding Rental Yield

Rental yield is a key metric used to evaluate the profitability of a rental property. It represents the return on investment (ROI) from rental income, expressed as a percentage.

There are two main types of rental yield: gross rental yield and net rental yield. Gross rental yield is a simpler calculation, considering only the annual rental income and property price. Net rental yield provides a more accurate picture by factoring in operating expenses such as property taxes, insurance, and maintenance costs.

Calculating rental yield is crucial for comparing potential investment properties and assessing their potential for generating income.

Property Condition and Age

A property’s physical state and age significantly influence its investment potential. Condition affects repair costs, rentability, and tenant appeal. A property in excellent condition might command higher rents and require less immediate investment, while one requiring extensive renovations could tie up capital and delay returns.

Age is another crucial factor. Newer properties may have modern amenities and lower maintenance needs, attracting a different tenant demographic than older, more character-rich properties. Consider the age-related expenses like plumbing, electrical, and roof updates, and factor these potential costs into your investment analysis.

Future Development Plans

Investigating future development plans in the surrounding area is crucial. Proposed infrastructure projects, new commercial centers, or residential developments can significantly impact property values. Understanding these plans can help you anticipate both positive and negative influences on your investment.

For example, a planned highway expansion might increase accessibility and boost property values, while a new landfill nearby could have the opposite effect. Research local government websites, attend community meetings, and stay informed about proposed projects to assess their potential impact on your investment.

Property Taxes and Other Expenses

Beyond the initial purchase price, investors must account for recurring expenses associated with property ownership. Property taxes are a significant expense, varying by location and property value. Failing to budget appropriately can significantly impact returns.

Other essential expenses include insurance (covering potential damages), maintenance (for repairs and upkeep), and potentially Homeowners Association (HOA) fees. Accurately estimating these ongoing costs is crucial for evaluating the true profitability of an investment.

Economic and Demographic Trends

Economic and demographic trends play a crucial role in real estate investment decisions. A thriving economy generally correlates with increased demand for housing and commercial properties, driving up prices and rental income. Conversely, economic downturns can lead to decreased demand and property devaluation.

Key economic indicators to consider include employment rates, interest rates, and inflation. Strong employment signifies greater housing affordability and demand. Interest rates influence borrowing costs, affecting both investors and potential buyers. Inflation impacts property values and rental rates.

Demographic factors such as population growth, age distribution, and migration patterns also influence real estate markets. A growing population usually fuels housing demand. The age distribution can indicate the types of properties in demand, such as retirement communities or family homes. Migration trends highlight areas experiencing growth and potential investment opportunities.

Investment Risk Management

Risk management is crucial for successful real estate investment. Understanding and mitigating potential risks can significantly impact your returns.

Key risks include:

- Market risk: Fluctuations in property values due to economic downturns or changes in local market conditions.

- Liquidity risk: Difficulty selling a property quickly due to limited buyer demand.

- Credit risk: Risk of tenant defaulting on rent payments.

- Legal risk: Potential legal disputes related to property ownership, zoning, or environmental regulations.

Strategies to mitigate risk include careful property selection, thorough due diligence, securing appropriate financing, and diversifying your real estate portfolio.

Access to Financing

Securing financing is crucial for most real estate investments. Understanding your financing options and having access to them is a key factor in successful investing. This involves researching loan types, comparing interest rates, and ensuring a strong credit score.

Consider the following:

- Down payment requirements: How much capital will you need upfront?

- Loan terms: What loan duration and repayment schedule work best for your investment strategy?

- Pre-approval: Getting pre-approved can strengthen your position when making offers.

Exit Strategies and Liquidity

Exit strategies are crucial in real estate investment. Planning how you’ll eventually dispose of the property is essential before making a purchase. Common exit strategies include selling the property, refinancing, or conducting a 1031 exchange. Each strategy has its own tax implications and potential returns.

Liquidity in real estate is comparatively lower than other investments like stocks. Selling a property can take time and effort. Factors influencing liquidity include market conditions, property location, and pricing. Understanding the potential challenges associated with selling your property is crucial for long-term financial planning.