Homeowners insurance is a crucial aspect of homeownership, providing financial protection against unexpected events that can damage your property or result in liability claims. Understanding the nuances of homeowners insurance policies, coverage options, and essential tips for selecting the right policy can save you significant money and stress in the long run. This comprehensive guide will delve into the key elements of homeowners insurance, equipping you with the knowledge to make informed decisions and secure adequate coverage for your most valuable asset.

Navigating the complexities of homeowners insurance can be daunting. From understanding different coverage types like dwelling coverage, personal property coverage, and liability coverage to deciphering policy exclusions and limitations, there’s a lot to consider. This article aims to simplify the process, providing essential tips for evaluating your needs, comparing insurance quotes, and ultimately choosing the best homeowners insurance policy that aligns with your budget and provides comprehensive protection for your home and belongings.

What Homeowners Insurance Covers

Homeowners insurance typically covers damage to your property and belongings from covered perils. These perils often include fire, windstorms, hail, and theft. It also provides liability protection if someone is injured on your property.

Dwelling coverage protects the physical structure of your home, including attached structures like garages. Personal property coverage protects your belongings inside the home, such as furniture, appliances, and clothing.

Other important coverages include loss of use, which helps pay for living expenses if your home is uninhabitable due to a covered loss, and medical payments coverage for minor injuries to guests on your property.

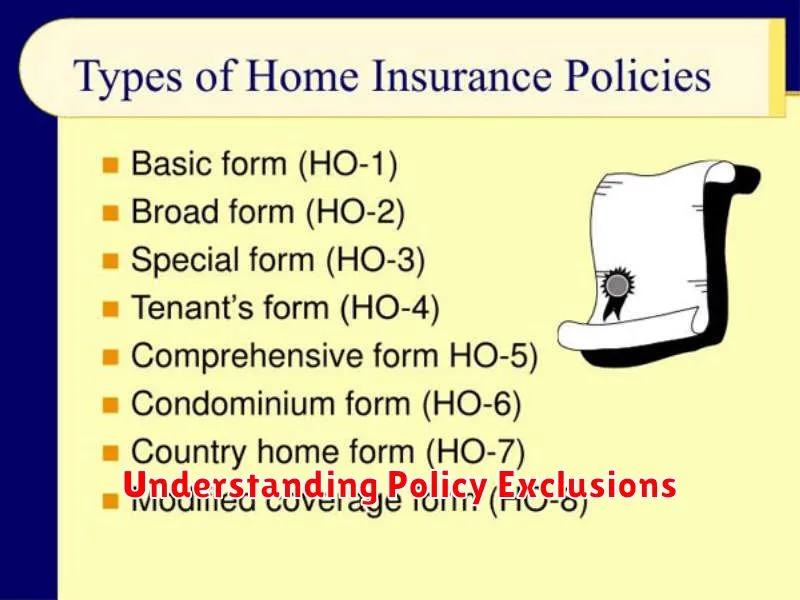

Types of Home Insurance Policies

Several types of homeowners insurance policies offer varying levels of coverage. Understanding these differences is crucial for choosing the right protection for your home.

Common Policy Types:

-

HO-1 (Basic Form): This policy provides limited coverage for a specific set of perils, such as fire, lightning, and vandalism.

-

HO-2 (Broad Form): This policy covers a wider range of perils than HO-1, including those listed in HO-1 plus additional perils like weight of ice, snow, or sleet.

-

HO-3 (Special Form): The most common type, HO-3 covers your dwelling and other structures on your property against all perils except those specifically excluded in the policy.

-

HO-5 (Comprehensive Form): Similar to HO-3, but also provides open-peril coverage for your personal belongings.

-

HO-8 (Modified Coverage Form): Designed for older homes, this policy provides coverage based on the actual cash value of the property.

How Insurance Premiums Are Calculated

Insurance premiums are calculated based on a number of factors, all designed to assess the risk the insurer takes on by covering your home. A higher perceived risk generally translates to higher premiums.

Location plays a significant role. Areas prone to natural disasters like hurricanes or wildfires will typically have higher premiums. Property value is also crucial, as rebuilding a more expensive home costs more. The age and condition of your home are factored in, with older homes potentially requiring higher premiums due to increased risk of issues like plumbing or electrical problems.

Your claims history also affects your premium. Frequent claims can lead to higher premiums. Finally, the coverage amount and deductible you choose influence your premium. Higher coverage and lower deductibles mean higher premiums.

Understanding Policy Exclusions

Policy exclusions are specific events or circumstances that your homeowners insurance does not cover. It’s crucial to understand these exclusions to avoid unexpected financial burdens should an excluded event occur. Reviewing your policy carefully will highlight these specifics.

Common exclusions include damage from floods, earthquakes, and nuclear hazards. Additionally, damage resulting from neglect of the property or intentional acts is typically excluded. Certain dog breeds may also be excluded from liability coverage.

Understanding your policy’s exclusions helps you make informed decisions about supplementary coverage, such as flood insurance or separate earthquake policies, if needed to fully protect your property.

Tips for Choosing Coverage Limits

Selecting appropriate coverage limits is crucial for adequate protection. Dwelling coverage should be enough to rebuild your home at current construction costs. Factor in potential increases in material and labor expenses.

Personal property coverage should reflect the actual cash value or replacement cost of your belongings. Create a home inventory to accurately assess your possessions’ value.

Liability coverage protects you against lawsuits for injuries or property damage. Choose limits that adequately safeguard your assets. Consider an umbrella policy for additional liability protection.

Importance of Personal Liability Coverage

Personal liability coverage is a crucial component of homeowners insurance. It provides financial protection against lawsuits for bodily injury or property damage that you or your family members may cause to others. This coverage extends to incidents occurring on your property and sometimes even off-premises.

Imagine someone slips and falls on your icy driveway. Without liability coverage, you could be personally responsible for their medical bills, lost wages, and even legal fees if they sue. Liability coverage can help cover these costs, protecting your assets and financial well-being.

The coverage also extends to damage you or your family cause to other people’s property. For example, if your child accidentally breaks a neighbor’s expensive window while playing ball, your liability coverage could help pay for the repairs. This protection offers valuable peace of mind, knowing you’re financially safeguarded against unforeseen accidents.

How to File an Insurance Claim

Filing a homeowner’s insurance claim can seem daunting, but following these steps can simplify the process. First, contact your insurance company immediately after the incident. Provide them with a detailed account of what happened, including the date, time, and location.

Next, document the damage thoroughly. This may include taking photos and videos of the affected areas and making a list of damaged or lost items. Keep all receipts related to temporary repairs and living expenses, if applicable.

Cooperate with the insurance adjuster when they inspect the damage. They will assess the extent of the loss and determine the amount covered by your policy. Be prepared to answer their questions and provide any additional documentation they request.

Assessing Additional Coverage Options

While a standard homeowners insurance policy provides crucial protection, it’s essential to assess if additional coverage options align with your specific needs. These options offer enhanced protection against events not typically covered by standard policies.

Flood insurance is a critical consideration, especially if your property is located in a flood-prone area. Standard policies typically exclude flood damage.

Earthquake insurance is another important option, particularly in earthquake-prone regions. Like flood insurance, earthquake coverage is usually separate from standard policies.

Valuable items coverage, sometimes called a “personal articles floater,” offers protection for high-value items like jewelry, art, or antiques. Standard policies may have limits on coverage for these items.

Regularly Reviewing Your Policy

Your homeowner’s insurance needs can change over time. Regular policy reviews, ideally annually, are essential to ensure adequate coverage. Life changes, like renovations, acquiring valuable items, or even changes in your neighborhood’s risk profile, can impact your coverage needs.

Failing to adjust your policy accordingly could leave you underinsured in the event of a claim. Review your coverage limits, deductibles, and endorsements to ensure they align with your current situation.

Common Home Insurance Mistakes to Avoid

Protecting your home with the right insurance coverage is crucial. However, many homeowners make common mistakes that can leave them underinsured or facing unexpected expenses. Avoiding these pitfalls can save you significant money and stress in the long run.

Underestimating Coverage Needs: One of the biggest mistakes is underestimating the amount of coverage needed to rebuild or repair your home. Factor in current construction costs, not just the home’s market value.

Ignoring Flood and Earthquake Coverage: Standard policies typically exclude flood and earthquake damage. If you live in an area prone to these risks, consider purchasing separate policies.

Neglecting to Update Your Policy: As you renovate or acquire valuable possessions, update your policy to reflect these changes. Failure to do so could lead to inadequate coverage in the event of a claim.

Not Understanding Your Deductible: Choose a deductible you can comfortably afford. A higher deductible lowers your premium, but you’ll pay more out-of-pocket if you file a claim.