Home equity is a crucial aspect of homeownership, representing the portion of your property that you truly own. It’s the difference between your home’s current market value and the outstanding balance on your mortgage. Understanding how home equity works is essential for making informed financial decisions, whether you’re considering renovations, debt consolidation, or leveraging your home’s value for other investments. This comprehensive guide will delve into the mechanics of home equity, exploring how it’s calculated, how it grows, and the various ways homeowners can access and utilize this valuable asset. Learn how to build equity strategically and unlock the financial potential of your home.

Navigating the complexities of home equity can seem daunting, but this guide provides a clear and concise overview to empower homeowners. We’ll explore the factors influencing home values, such as market trends and property improvements, and discuss how these factors impact your equity. You’ll gain a practical understanding of how mortgage payments contribute to equity growth and learn about different home equity loan options, including lines of credit and second mortgages. By the end of this guide, you will have the knowledge and confidence to make informed decisions about leveraging your home equity to achieve your financial goals.

What is Home Equity?

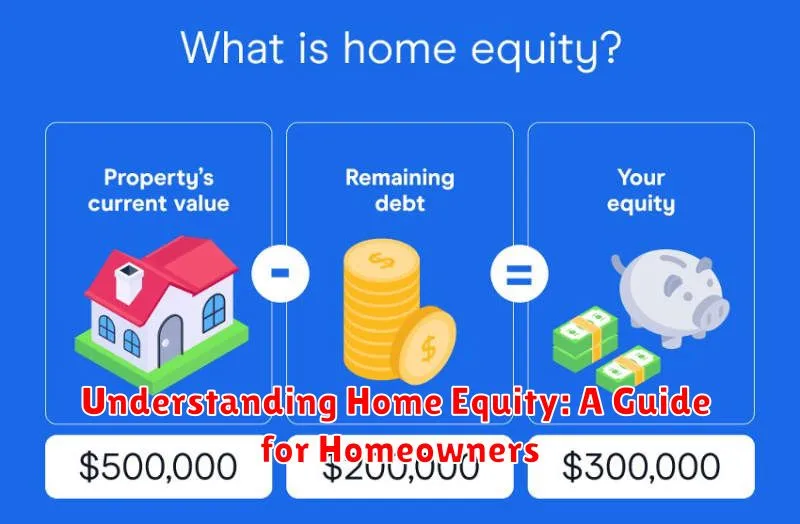

Home equity is the portion of your home’s value that you truly own. It’s calculated by subtracting the amount you still owe on your mortgage from your home’s current market value. In simpler terms, it’s the difference between what your home is worth and what you still owe on it.

For example, if your home is worth $300,000 and you owe $150,000 on your mortgage, your home equity is $150,000.

How to Calculate Home Equity

Calculating your home equity is a straightforward process. It involves subtracting the amount you still owe on your mortgage (your current loan balance) from the current market value of your home.

For example, if your home is currently worth $300,000 and you owe $200,000 on your mortgage, your home equity is $100,000.

It’s important to remember that your home’s market value can fluctuate. Factors such as market conditions and home improvements can influence its value. Staying updated on your local housing market can provide a general sense of your home’s worth. For a more precise valuation, consider a professional appraisal.

Benefits of Building Equity

Building home equity offers several significant financial advantages. Equity acts as a valuable asset that can be leveraged for various purposes. As your equity grows, so does your financial stability and flexibility.

A key benefit is the potential to access funds through a home equity loan or line of credit (HELOC). These options allow you to borrow against your accumulated equity, providing funds for home improvements, debt consolidation, or other major expenses.

Growing equity also provides a financial safety net. In times of financial hardship, your equity can serve as a buffer. Furthermore, substantial equity can make it easier to qualify for better loan terms and interest rates in the future.

Using Home Equity Loans and Lines of Credit

A home equity loan provides a lump sum of money upfront, repaid over a fixed term with a fixed interest rate. This option is suitable for large, one-time expenses like home renovations or debt consolidation.

A home equity line of credit (HELOC) works like a credit card, offering a revolving credit line you can draw from as needed. The interest rate is typically variable, and you only pay interest on the amount you borrow. HELOCs are useful for ongoing expenses like education or home improvements completed in stages.

Both options use your home as collateral, meaning responsible borrowing is crucial. Defaulting on payments could lead to foreclosure.

Factors Affecting Your Equity

Several key factors influence the amount of equity you hold in your home. Market Value fluctuations play a significant role. As property values rise, so does your equity. Conversely, declining market conditions can erode your equity position.

Your Mortgage Balance is another critical factor. Regular principal payments increase your equity, while taking on additional debt, like a second mortgage, decreases it.

Home Improvements that enhance your property’s value contribute positively to your equity. These can include renovations, additions, or upgrades.

Risks of Leveraging Home Equity

Leveraging home equity, while potentially beneficial, carries inherent risks. Reduced Ownership Stake is a primary concern. Borrowing against your home diminishes your equity, increasing vulnerability to market fluctuations. If home values decline, you could owe more than your home is worth.

Interest Payments add to the overall cost. While interest may be tax-deductible (consult a tax advisor), it still represents a significant expense. Foreclosure is the most serious risk. Failure to repay the loan as agreed can lead to the loss of your home.

Variable Interest Rates, common with certain home equity loans, can increase monthly payments unpredictably, making budgeting challenging. Finally, Impact on Credit Score is another factor. Missed payments or high loan utilization can negatively affect your creditworthiness.

Increasing Your Home’s Equity

Building equity in your home is a key aspect of homeownership. There are two primary ways to increase your home’s equity: increasing your home’s market value and decreasing your mortgage principal.

Improving your home’s value can involve renovations and upgrades. Focusing on high-impact renovations like kitchen or bathroom remodels can offer a substantial return on investment. Regular maintenance and upkeep also contribute to preserving and potentially enhancing value.

Reducing your mortgage principal is achieved by making regular payments, and by making additional principal payments whenever possible. Consistently paying down your principal accelerates equity growth. Refinancing to a lower interest rate can also reduce the overall cost of the loan and free up cash flow that can be used for further principal reduction or home improvements.

Equity vs. Refinancing

Home equity and refinancing are related but distinct concepts. Equity represents the portion of your home that you truly own, calculated as the difference between your home’s current market value and the outstanding balance on your mortgage. Refinancing, on the other hand, is the process of replacing your existing mortgage with a new one, often with different terms.

You can leverage your home equity through refinancing. For instance, a cash-out refinance allows you to access a portion of your equity by taking out a new, larger mortgage. The difference between the new mortgage and the old one is paid to you in cash. Refinancing can also be used to obtain a lower interest rate, shorten the loan term, or switch from an adjustable-rate mortgage to a fixed-rate mortgage.

Tax Implications of Home Equity

While home equity itself isn’t directly taxed, certain actions related to it can have tax implications. It’s crucial to understand these potential impacts to make informed financial decisions.

Home Equity Loan and HELOC Interest Deductibility: Interest paid on home equity loans and lines of credit (HELOCs) may be tax deductible, but only if the funds are used to buy, build, or substantially improve the home that secures the loan. The IRS sets limits on the amount of deductible debt, so it’s important to consult the current regulations. Interest on loans used for other purposes, like debt consolidation or personal expenses, is generally not deductible.

Capital Gains Exclusion: When you sell your home, you may be able to exclude a portion of the profit (capital gains) from your taxable income. This exclusion can be substantial, allowing individuals to exclude up to $250,000 and married couples filing jointly up to $500,000. Meeting certain ownership and use requirements is essential to qualify for this exclusion.

Managing Equity Responsibly

Building home equity is a significant financial achievement. However, it’s crucial to manage this asset responsibly to avoid potential pitfalls. Tapping into equity through loans or lines of credit can provide funds for important goals like home improvements or debt consolidation.

However, borrowing against your home increases your debt load and puts your home at greater risk of foreclosure if you’re unable to make payments. Carefully consider the long-term implications before using your home equity as collateral.

Furthermore, resist the urge to repeatedly borrow against accumulating equity. Over-leveraging can leave you with little equity cushion in the event of a market downturn. Prudent financial planning and responsible equity management are key to safeguarding your financial future.