Choosing the right mortgage can be a daunting task, especially with the wide array of mortgage types available. This comprehensive guide breaks down the complexities of various mortgages, providing you with the knowledge necessary to confidently select the best mortgage type for your individual financial circumstances. Whether you are a first-time homebuyer or a seasoned real estate investor, understanding the nuances of each mortgage option is crucial for long-term financial success. From fixed-rate and adjustable-rate mortgages to FHA, VA, and USDA loans, we’ll explore the key features, advantages, and disadvantages to empower you in making an informed decision. This guide aims to simplify the mortgage selection process, enabling you to navigate the world of home financing with ease and clarity.

This Guide to Choosing the Best Mortgage Type examines various mortgage options including fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA loans, VA loans, USDA loans, and more. We will delve into the specifics of each mortgage type, discussing factors such as interest rates, loan terms, down payment requirements, and closing costs. By understanding these elements, you can confidently compare mortgage offers and select the best mortgage that aligns with your financial goals and risk tolerance. This guide is designed to equip you with the tools and information needed to make a sound and informed decision when choosing the most suitable mortgage for your home purchase.

Understanding Fixed-Rate Mortgages

A fixed-rate mortgage is a home loan where the interest rate remains constant throughout the entire loan term. This means your monthly principal and interest payments stay the same, making budgeting predictable and straightforward.

These mortgages are popular due to their stability and simplicity. They are especially attractive during times of fluctuating interest rates, as your payments remain unaffected by market changes. While the initial interest rate might be slightly higher than adjustable-rate mortgages, the long-term predictability offers peace of mind.

Fixed-rate mortgages are typically available in 15-year and 30-year terms. A shorter term results in higher monthly payments but less interest paid over the life of the loan. Conversely, a longer term offers lower monthly payments but higher overall interest costs. Choosing the right term depends on your individual financial situation and long-term goals.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) offer initially lower interest rates compared to fixed-rate mortgages. This can translate to lower monthly payments for a set period, typically 3, 5, 7, or 10 years. This makes ARMs potentially attractive for borrowers who plan to sell or refinance before the rate adjusts.

However, ARMs carry the risk of fluctuating interest rates. After the initial fixed-rate period expires, the interest rate can adjust periodically, typically annually. This can lead to significantly higher monthly payments, making budgeting challenging. The interest rate changes are based on a specified index, and the rate is capped by a margin. Understanding these factors is crucial when considering an ARM.

Interest-Only Mortgages Explained

With an interest-only mortgage, you initially only make payments toward the interest accrued on your loan. This results in lower monthly payments compared to a traditional amortizing mortgage during the interest-only period.

Key features of interest-only mortgages include a specified interest-only period, typically ranging from 5 to 10 years. After this period ends, your payments will increase as you begin paying down the principal balance. It is crucial to understand how your payments will change after the interest-only period expires.

Borrowers often choose interest-only mortgages to free up cash flow in the short term or when anticipating increased income in the future. However, it’s important to consider the risks involved, such as potentially higher payments later and the possibility of owing more than the initial loan amount if the property value declines.

Jumbo Loans and Their Requirements

Jumbo loans exceed conforming loan limits set by the Federal Housing Finance Agency (FHFA). These limits vary by location, reflecting higher home prices in certain areas. Because jumbo loans represent a higher risk for lenders, they come with stricter requirements.

Borrowers typically need excellent credit scores, often above 700. Larger down payments are also common, sometimes reaching 20% or more of the purchase price. Lenders also scrutinize debt-to-income ratios closely, preferring lower ratios to ensure borrowers can comfortably manage the larger loan payments. Reserves, or liquid assets, demonstrating the ability to cover several months of mortgage payments are frequently required.

Government-Backed Mortgages

Government-backed mortgages are insured or guaranteed by a federal agency. This backing protects the lender against loss if the borrower defaults, allowing lenders to offer more favorable terms.

Types of Government-Backed Mortgages:

- FHA Loans: Insured by the Federal Housing Administration. These loans often have lower down payment requirements and are more accessible to borrowers with less-than-perfect credit.

- VA Loans: Guaranteed by the Department of Veterans Affairs. These loans are available to eligible veterans, service members, and surviving spouses, often requiring no down payment.

- USDA Loans: Guaranteed by the United States Department of Agriculture. These loans are designed for borrowers in designated rural areas and often come with low interest rates and no down payment requirements.

While government-backed loans offer significant advantages, they often come with additional fees, such as mortgage insurance premiums.

Evaluating Your Financial Stability

Before committing to a mortgage, it’s crucial to thoroughly assess your financial standing. This involves understanding your current income, expenses, and overall debt levels.

Start by calculating your debt-to-income ratio (DTI). This is a key metric lenders use to assess your ability to repay a loan. A lower DTI indicates greater financial stability.

Also, consider your credit score. A higher credit score often translates to better interest rates and loan terms. Review your credit report for any errors and take steps to improve your score if necessary.

Finally, evaluate your savings. Having a substantial down payment can reduce your monthly payments and improve your chances of loan approval. It also provides a financial cushion in case of unexpected expenses.

Comparing Loan Terms and Conditions

Carefully comparing loan terms and conditions is crucial when choosing a mortgage. Loan term refers to the length of time you have to repay the loan, typically 15 or 30 years. A shorter term means higher monthly payments but less interest paid overall. A longer term results in lower monthly payments, but you’ll pay more interest over the life of the loan.

Interest rate is the cost of borrowing money. Compare rates from different lenders to find the best offer. Consider whether you want a fixed rate, which stays the same for the entire loan term, or an adjustable rate, which can fluctuate based on market conditions.

Fees, such as closing costs, appraisal fees, and origination fees, can vary significantly between lenders. Compare these fees and factor them into your overall cost.

Long-term vs. Short-term Mortgages

When choosing a mortgage, a crucial decision revolves around the loan’s term – the length of time you’ll have to repay it. Long-term mortgages, typically 30 years, offer lower monthly payments but accrue more interest over time. This can result in a significantly higher overall cost.

Short-term mortgages, such as 15-year loans, require higher monthly payments. However, they offer a faster path to owning your home outright and result in substantially less interest paid over the life of the loan. Choosing the right term depends on your individual financial circumstances and long-term goals.

Hidden Fees and Charges

While comparing mortgage interest rates is crucial, beware of hidden fees that can significantly impact the overall cost. Some lenders might advertise low rates but compensate with higher fees.

Common hidden fees include application fees, appraisal fees, processing fees, and underwriting fees. Prepayment penalties might also apply if you decide to pay off your mortgage early.

Carefully review the Loan Estimate and Closing Disclosure provided by your lender. These documents outline all costs associated with the loan, allowing you to compare offers accurately. Asking lenders for a complete breakdown of all potential fees upfront is essential.

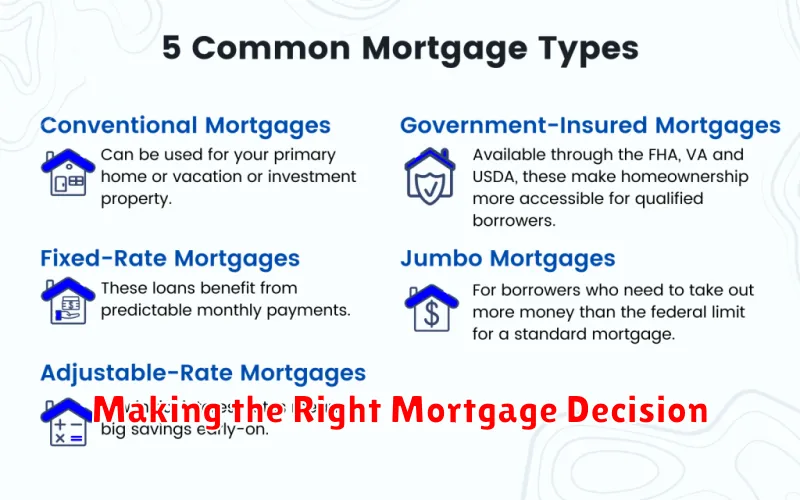

Making the Right Mortgage Decision

Choosing the right mortgage is a crucial step in homeownership. It significantly impacts your financial future, so careful consideration is essential.

Several factors play a key role in this decision. Your financial situation, including income, debt, and credit score, is paramount. The type of home you’re buying and the current market conditions also influence the best mortgage option for you.

Understanding the different mortgage types available is the first step. Compare fixed-rate mortgages with adjustable-rate mortgages (ARMs), considering their respective advantages and disadvantages in light of your individual circumstances. Evaluate loan terms, interest rates, and closing costs to make an informed decision.