Embarking on your real estate investment journey can feel daunting, but with the right knowledge and strategies, it can be a rewarding experience. This comprehensive guide on real estate investment strategies for beginners will equip you with the foundational knowledge you need to make informed decisions and build a profitable portfolio. We’ll cover key concepts such as analyzing real estate markets, understanding different investment properties, and evaluating potential returns on investment. Whether you’re interested in rental properties, fix-and-flips, or REITs, understanding the basics is crucial for success in real estate investing.

From navigating financing options and assessing property values to managing real estate risks, this guide breaks down complex concepts into digestible steps. We’ll explore various real estate investment strategies suitable for beginners, including house hacking, wholesaling, and investing in real estate investment trusts (REITs). Learn how to evaluate investment opportunities, conduct thorough due diligence, and build a real estate investment portfolio tailored to your financial goals. Start your real estate investment journey with confidence by understanding the essential strategies for long-term success.

Understanding Real Estate Basics

Before diving into investment strategies, it’s crucial to grasp the fundamentals of real estate. Property refers to land and any structures built on it. Real estate encompasses the property itself, along with the bundle of rights associated with ownership.

These rights include the right to possess, control, enjoy, exclude others from, and dispose of the property. Understanding these core concepts is the first step towards making informed investment decisions.

Key factors influencing real estate value include location, market conditions, and the property’s condition. Analyzing these factors is crucial for successful investing.

Starting with Small Investments

Entering the real estate market doesn’t necessarily require a fortune. Several avenues exist for beginners to start with smaller investments. REITs (Real Estate Investment Trusts) offer a straightforward entry point, allowing you to invest in portfolios of properties without direct ownership. These are traded like stocks, providing liquidity and diversification.

Another option is crowdfunding platforms. These platforms pool funds from multiple investors to finance real estate projects, enabling participation with lower capital requirements. Thorough research and due diligence are crucial before committing to any platform.

Using Leverage Wisely

Leverage, in real estate, refers to using borrowed capital (mortgages) to purchase a property. It can amplify returns but also magnify losses. Understanding and managing leverage is crucial for beginners.

A higher loan-to-value ratio (LTV) means more leverage. While a larger loan can increase potential profits, it also increases your risk. Lower monthly payments associated with smaller loans may be more manageable, particularly during market downturns.

Carefully assess your financial situation and risk tolerance before deciding on the appropriate leverage. Consider factors like income stability, existing debt, and potential interest rate fluctuations.

Identifying Promising Locations

One of the most critical aspects of real estate investment is selecting the right location. A promising location can significantly impact your return on investment.

Consider these key factors when evaluating a location:

- Job Growth: Areas with strong job growth attract new residents, driving housing demand.

- Population Growth: A growing population indicates a healthy real estate market.

- Amenities and Infrastructure: Proximity to schools, hospitals, and transportation options enhances a location’s desirability.

- Neighborhood Quality: Look for safe, well-maintained neighborhoods with low crime rates.

- Future Development Plans: Be aware of planned developments that could impact property values.

By carefully analyzing these factors, you can increase your chances of selecting a location with strong potential for appreciation and positive cash flow.

Rental vs. Flip Strategies

Choosing between a rental and flipping strategy is a crucial first step in real estate investment. Both offer distinct advantages and disadvantages, catering to different investment styles and financial goals.

Rental properties generate passive income through monthly rent payments. This strategy focuses on long-term growth and wealth building through appreciation and equity buildup. It requires property management and tenant interactions.

Flipping, on the other hand, involves buying a property, renovating it, and selling it quickly for a profit. This strategy demands market knowledge, renovation expertise, and the ability to manage projects efficiently. It offers the potential for higher returns in a shorter timeframe but carries greater risk.

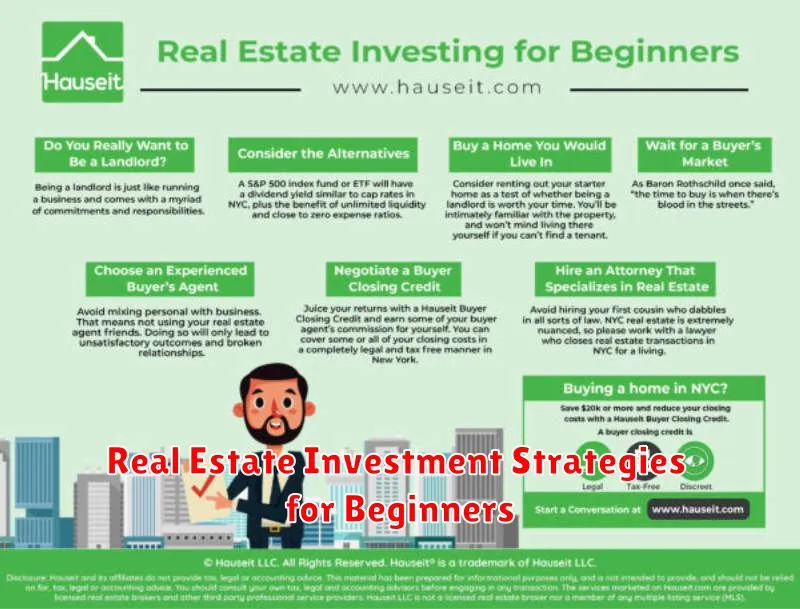

Building Your Investment Team

Real estate investment isn’t a solo endeavor. A strong team is crucial for success. As a beginner, focus on building a core team comprising key professionals.

A real estate agent experienced in investment properties can provide valuable market insights and help you locate suitable deals. A real estate attorney will ensure legal compliance and review contracts. Finally, a mortgage broker or lender will facilitate financing for your investments.

As your portfolio grows, consider adding other professionals like property managers, accountants, and contractors to streamline operations and maximize returns.

Managing Risks Effectively

Risk management is crucial for successful real estate investment. Understanding and mitigating potential risks can protect your investment and maximize returns. Several key areas require attention.

Market Risk

Market fluctuations can impact property values. Thorough market research and analysis are essential to understand local market trends, rental rates, and potential for appreciation or depreciation.

Property-Specific Risks

Carefully assess the condition of the property through inspections. Consider factors like age, maintenance needs, and potential for environmental hazards.

Financial Risks

Secure favorable financing terms and ensure you can comfortably manage mortgage payments. Budget for unexpected expenses like repairs and vacancies.

Legal Risks

Consult with a real estate attorney to ensure all legal requirements are met. Review contracts, titles, and lease agreements carefully to protect your interests.

Keeping Financial Records

Maintaining meticulous financial records is crucial for successful real estate investment. Accurate record-keeping allows you to track expenses, income, and overall property performance. This information is essential for making informed decisions, securing financing, and accurately assessing your investment’s profitability.

Key records to maintain include purchase agreements, loan documents, insurance policies, tax records, and all receipts related to property expenses (repairs, maintenance, property taxes). Consider utilizing dedicated accounting software or hiring a bookkeeper, especially as your portfolio grows.

Organized financial records simplify tax preparation and can be invaluable during audits. They also enable you to effectively analyze your investments and identify areas for improvement or potential cost savings.

Learning from Experienced Investors

One of the most valuable resources for new real estate investors is the experience of those who have already navigated the market successfully. Networking with seasoned investors can provide invaluable insights.

Consider joining local real estate investment clubs or attending industry events. These gatherings offer opportunities to connect with experienced individuals. Mentorship can also be incredibly beneficial. Finding an experienced investor willing to share their knowledge can significantly shorten your learning curve.

Don’t hesitate to ask questions and actively listen to their advice. Learning from their successes and, importantly, their mistakes, can help you avoid potential pitfalls and make more informed decisions.

Planning for Long-Term Growth

Long-term growth in real estate requires careful planning and a strategic approach. Patience is key, as significant returns often take time to materialize.

Consider these factors for long-term success:

- Market Analysis: Research areas with consistent growth potential. Look at historical data, economic indicators, and future development plans.

- Investment Goals: Define your objectives. Are you seeking rental income or property appreciation? Align your strategy accordingly.

- Risk Tolerance: Evaluate your comfort level with potential market fluctuations. Long-term strategies generally mitigate risk, but market shifts can still occur.