Deciding where to live is a significant decision. Are you trying to decide between renting an apartment or buying a house? Choosing the right living situation depends on a multitude of factors, including your lifestyle, finances, and long-term goals. This article explores the key considerations involved in choosing between an apartment and a house, helping you determine the best fit for your individual needs. We’ll delve into the advantages and disadvantages of each option, covering topics such as cost, maintenance, space, and amenities, to guide you toward making an informed decision. Whether you are a young professional, a growing family, or someone looking to downsize, understanding the nuances of each housing type is crucial.

Making the choice between an apartment and a house can be challenging. This article provides a comprehensive comparison, examining the pros and cons of apartment living versus homeownership. We’ll cover the financial implications of each, including upfront costs, monthly payments, and potential tax benefits. We’ll also explore the lifestyle differences, such as community living versus privacy, and the responsibilities associated with each, from maintenance and repairs to HOA fees and property taxes. By weighing these factors, you can confidently determine whether the flexibility of an apartment or the stability of a house aligns better with your current circumstances and future aspirations.

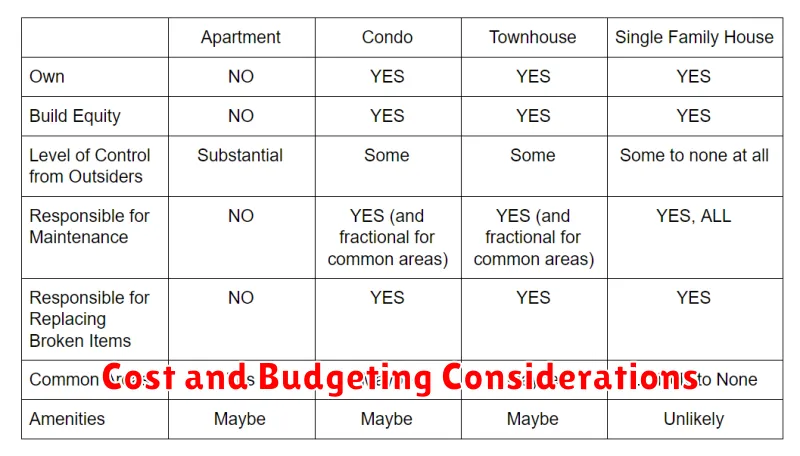

Comparing Maintenance Responsibilities

A key difference between apartments and houses lies in maintenance responsibilities. In an apartment, the landlord or property management company typically handles most maintenance tasks. This includes repairs to appliances, plumbing, heating/cooling systems, and the building exterior. Tenants are generally responsible for maintaining the cleanliness of their unit and may be liable for damages caused by negligence.

Homeowners, on the other hand, bear the full responsibility for all maintenance and repairs. This encompasses everything from routine upkeep like lawn care and appliance maintenance to major repairs such as roof replacements and plumbing overhauls. While this offers greater control over the property, it also requires a significant time and financial commitment.

Considering Space and Layout Needs

A crucial factor in deciding between a house and an apartment is understanding your space and layout requirements. Square footage plays a significant role. Do you need ample room for a growing family, or is a cozy space sufficient? Consider also the number of bedrooms and bathrooms required.

Beyond square footage, think about the layout. Apartments often come with fixed layouts, while houses offer more flexibility for customization. Consider whether you need dedicated spaces like a home office, a guest room, or a formal dining area. Storage is another key aspect. Houses typically offer more storage options than apartments, including attics, basements, and garages.

Evaluating Lifestyle and Convenience

A key factor in deciding between a house and an apartment lies in evaluating your preferred lifestyle and desired level of convenience. Apartment living often offers a low-maintenance lifestyle. Amenities like laundry facilities, gyms, and pools are often included, minimizing personal responsibilities. Proximity to urban centers and public transportation is another significant advantage for apartment dwellers.

Homeownership, conversely, prioritizes space and privacy. While requiring more upkeep, owning a house provides greater control over your living environment and the freedom to customize it to your needs. Consider your tolerance for maintenance tasks and your willingness to invest time and effort in property upkeep when making your decision.

Cost and Budgeting Considerations

One of the most critical factors in deciding between a house and an apartment is cost. Both options come with distinct expenses that must be carefully considered.

Renting an apartment typically involves a monthly rent payment and potentially utility costs. Security deposits are also common. Upfront costs are generally lower than purchasing a house.

Buying a house involves a larger upfront investment, including a down payment, closing costs, and potential mortgage insurance. Recurring costs include property taxes, homeowner’s insurance, and maintenance expenses. While more expensive initially, homeownership offers the potential for building equity.

Carefully analyze your budget, including your income, debts, and savings. Factor in both upfront and ongoing costs to determine which option aligns best with your financial situation.

Privacy and Community Factors

Privacy concerns often differ between houses and apartments. Houses generally offer more privacy, with yards and greater distance from neighbors. Apartments, particularly those in larger buildings, tend to have less privacy due to shared walls, hallways, and common areas.

Community aspects also vary. Apartment complexes may offer built-in social opportunities through shared amenities like pools or fitness centers, fostering a sense of community. Houses typically offer more autonomy but may require more effort to cultivate connections with neighbors.

Consider your preferences for privacy and community engagement when making your choice.

Resale and Rental Potential

Resale value is a crucial factor to consider. Houses historically appreciate in value more than apartments, making them a potentially stronger long-term investment. However, location plays a significant role in both house and apartment appreciation.

Rental potential differs as well. Houses offer the flexibility of renting the entire property, while apartments can typically only be rented individually. Demand for rentals in your area should be researched if generating income is a priority.

Location and Accessibility

Location plays a crucial role in the apartment versus house debate. Apartments are frequently situated in urban centers, offering proximity to businesses, entertainment, and public transportation. Houses, conversely, are more common in suburban or rural areas, providing larger spaces and greater privacy.

Accessibility needs also factor into the decision. Apartments may offer amenities like elevators and ramps, catering to individuals with mobility limitations. Houses, while adaptable, may require renovations for accessibility features. Consider your current and future needs when evaluating this aspect.

Long-Term Investment Benefits

When considering long-term investment potential, both apartments and houses offer distinct advantages. Houses historically appreciate in value, building equity over time. This makes homeownership a powerful wealth-building tool.

Apartments, while not directly appreciating in the same way, offer indirect investment benefits. Renters can allocate funds that would otherwise go towards property taxes, maintenance, and down payments into other investment vehicles like stocks or bonds.

The best choice depends on individual financial goals and risk tolerance.

Customization and Renovation Possibilities

A key difference between apartments and houses lies in the degree of permitted customization. Apartments typically have strict rules regarding renovations. Often, even seemingly minor changes like painting walls require prior approval from the landlord. Major renovations are usually out of the question.

Houses, on the other hand, offer significantly more freedom. Homeowners have substantial control over renovations and customizations, from repainting and landscaping to major structural changes. This flexibility allows for personal expression and creating a space truly tailored to individual needs and preferences. However, it’s crucial to remember that these freedoms come with the responsibility of managing and financing any renovation projects.

Making the Final Decision

After carefully weighing the pros and cons of both apartments and houses, it’s time to make the final decision. This choice depends heavily on your individual circumstances, lifestyle, and financial situation.

Review your prioritized needs and wants list. Does the flexibility of an apartment better suit your current stage of life? Or is the stability and space of a house more aligned with your long-term goals? Consider your budget limitations, desired location, and preferred lifestyle.

Trust your instincts. The right choice will feel right. Once you’ve made your decision, move forward confidently knowing you’ve made the best choice for your unique needs.