Understanding property taxes is crucial for every homeowner. These taxes constitute a significant portion of homeownership costs and are essential for funding local services such as schools, roads, and public safety. This comprehensive guide will delve into the intricacies of property taxes, providing homeowners with a clear understanding of how they are calculated, assessed, and paid. We’ll explore the factors influencing property tax rates, discuss exemptions and deductions that may apply, and offer practical tips for managing your property tax obligations effectively. Whether you’re a first-time homebuyer or a seasoned homeowner, this guide will equip you with the knowledge you need to navigate the complexities of property taxes with confidence.

Navigating the world of property taxes can often feel overwhelming. From understanding assessments and appeals to deciphering the various components of your tax bill, there’s a lot to learn. This guide will break down the complexities of property tax, offering a step-by-step approach to understanding the entire process. We’ll examine how property values are assessed, how tax rates are determined, and how you can potentially reduce your property tax burden. By demystifying the property tax system, we aim to empower homeowners to take control of their finances and make informed decisions about their most valuable asset.

What Are Property Taxes?

Property taxes are ad valorem taxes assessed on real estate. This means the tax amount due is based on the assessed value of the property. These taxes are levied by local governments, such as counties, cities, and school districts, and are a primary source of their funding.

Properties subject to property tax typically include land, buildings, and sometimes personal property used for business purposes. The assessed value is usually determined by a government assessor and reflects the market value of the property.

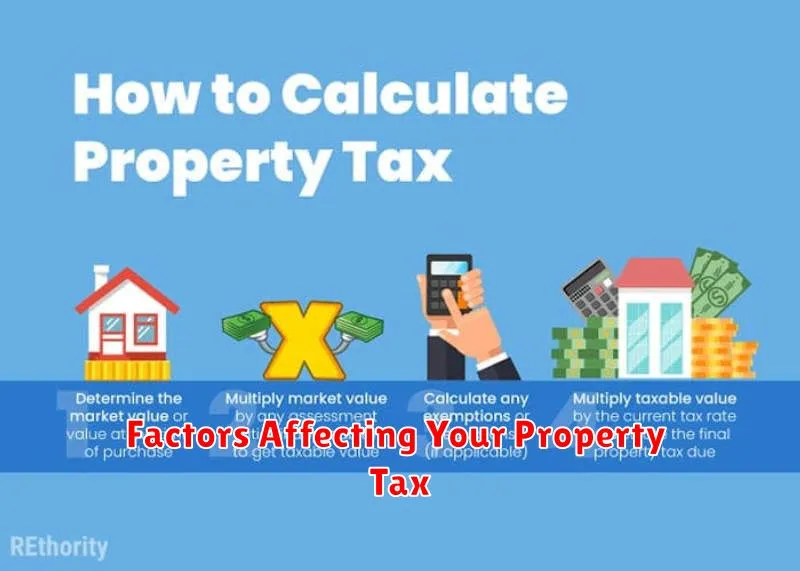

How Property Taxes Are Calculated

Property taxes are calculated based on the assessed value of your property and the local tax rate. The assessed value is typically determined by your local government’s assessor and represents a percentage of your property’s market value.

The tax rate is established by local governing bodies, such as cities, counties, and school districts, to fund public services like schools, roads, and parks. This rate is usually expressed as a percentage or in mills (dollars per $1,000 of assessed value).

The basic formula for calculating property tax is: Assessed Value x Tax Rate = Property Tax. Therefore, a higher assessed value or tax rate results in higher property taxes.

Factors Affecting Your Property Tax

Several key factors influence how your property tax is calculated. Understanding these factors can help you better estimate your tax liability and plan accordingly. Property Value is the most significant determinant. Higher assessed values generally lead to higher taxes.

Location also plays a crucial role. Tax rates vary significantly between different municipalities and even within neighborhoods of the same city or town. Local government budgets and the demand for public services in your area directly impact your tax rate.

Property type can also influence your tax burden. Residential, commercial, and industrial properties often have different tax rates applied to them.

How to Appeal Your Property Tax Assessment

If you believe your property tax assessment is too high, you have the right to appeal it. The process typically involves filing a formal appeal with your local assessment appeals board or similar entity. Deadlines for filing are often strict, so be sure to check with your local taxing authority.

Gather evidence to support your claim. This might include recent comparable sales data for similar properties in your area, an independent appraisal, or documentation of any property defects that might lower its value.

Be prepared to present your case clearly and concisely to the appeals board. Explain why you believe the assessment is inaccurate and provide supporting documentation. Be respectful and professional throughout the process.

Understanding Tax Exemptions and Reliefs

Tax exemptions and tax reliefs can significantly reduce your overall property tax burden. Understanding these programs is crucial for homeowners looking to manage their tax liabilities.

An exemption lowers the assessed value of your property, thus reducing the tax owed. Common exemptions include those for homeowners, senior citizens, veterans, and individuals with disabilities. Eligibility requirements vary by jurisdiction.

Relief programs, on the other hand, generally offer a direct reduction in the tax amount owed. These programs might be based on income, age, or other factors. They often target specific demographics, such as low-income households or senior citizens.

Impact of Taxes on Property Investments

Property taxes play a significant role in real estate investment decisions. They directly affect the overall profitability of a property.

Increased property taxes can reduce your net income and potentially impact your return on investment (ROI). Conversely, lower property taxes can make an investment more attractive and boost profitability.

It’s essential to factor in potential tax increases or decreases when evaluating a property for investment. Analyzing historical tax data for the area and understanding local government policies can help investors make informed decisions.

Importance of Budgeting for Property Taxes

Property taxes constitute a significant recurring expense for homeowners. Failing to budget for these taxes can lead to financial strain and even property loss through tax liens. Accurately forecasting and allocating funds for property taxes is crucial for responsible homeownership.

Budgeting allows homeowners to anticipate the financial impact of these taxes and avoid unexpected expenses. This is especially important because property tax rates and assessed values can fluctuate.

By setting aside funds regularly, homeowners can ensure they have the necessary resources available when property tax payments are due. This proactive approach helps maintain financial stability and avoids penalties associated with late payments.

State vs. Local Property Taxes

Property taxes are primarily levied at the local level. This means cities, counties, school districts, and other municipal entities are the primary beneficiaries of property tax revenue. These local governments use the collected taxes to fund essential services such as schools, libraries, parks, and public safety.

While some states may also impose a state property tax, it is generally much smaller than local property taxes, or in some cases, nonexistent. Where applicable, state-levied property taxes typically support statewide initiatives or provide supplemental funding to local governments.

The variation in how states and localities handle property taxes creates significant differences in effective tax rates across jurisdictions. Understanding the interplay between state and local property tax policies is crucial for homeowners to accurately assess their tax burdens.

Keeping Records for Tax Purposes

Maintaining accurate records is crucial for property tax matters. Proper documentation can help you substantiate your tax assessments and potentially reduce your tax burden. It’s also essential if you decide to appeal your property tax assessment.

Key records to keep include:

- Property tax assessments

- Property tax bills

- Receipts for property tax payments

- Records of any home improvements or renovations (including permits and contractor invoices)

- Documentation supporting any deductions or exemptions you claim

Organize these documents chronologically for easy retrieval. Consider keeping both physical and digital copies.

Planning for Property Tax Changes

Property taxes are rarely static. Regular reassessments can lead to fluctuations in your tax bill. Understanding potential changes and planning accordingly is crucial for managing your finances.

Monitor local government budgets and proposed tax levies. These often signal upcoming changes. Attend public hearings and stay informed about decisions affecting your property taxes.

Factor potential increases into your long-term budget. This will help avoid financial strain if your taxes rise significantly. Consider setting aside a small amount each month to cover potential increases.