Buying a home is a significant investment, often the largest purchase of your lifetime. Before committing to such a substantial financial undertaking, it’s essential to conduct thorough due diligence. Checking key aspects of the property and its surrounding area can prevent future headaches and ensure a sound investment. This article will guide you through the essential things to check before buying a home, covering everything from structural integrity and neighborhood safety to financial considerations and legal documentation. Understanding these crucial factors will empower you to make an informed decision and confidently embark on your homeownership journey. Whether you’re a first-time homebuyer or a seasoned investor, this guide will provide invaluable insights into the essential steps for a successful home purchase.

From evaluating the home’s condition and assessing property taxes to understanding homeowners insurance and navigating closing costs, we’ll delve into the critical details that demand your attention. Learn how to evaluate the neighborhood, inspect the property for potential issues, and analyze your financial readiness. This comprehensive overview of the essential things to check before buying a home will equip you with the knowledge and confidence to make a well-informed decision and secure the home of your dreams.

Evaluate the Location Carefully

Location is a critical factor in home buying. It impacts lifestyle, commute, and future property value. Consider the proximity to essential amenities like schools, hospitals, and shopping centers.

Think about your commute time and the availability of public transportation. Research the neighborhood’s safety statistics and the overall community atmosphere. Is it a quiet residential area or a bustling urban center? Choosing the right location significantly impacts your long-term satisfaction with your home purchase.

Inspect the Structural Integrity

A home’s structural integrity is paramount. Foundation issues can be costly and disruptive. Look for signs of cracking, settling, or uneven floors. Walls should be plumb and free of large cracks. Check the roof for missing shingles, sagging, or signs of water damage. Framing should be sound, with no signs of rot or insect infestation.

Consider hiring a professional home inspector. Their trained eye can spot potential problems you might miss. A thorough inspection is a worthy investment that can save you significant expense and heartache in the future.

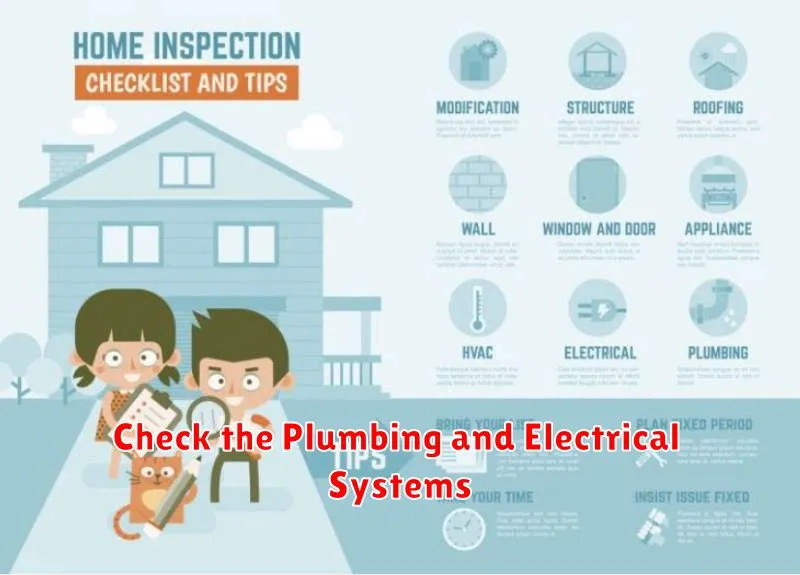

Check the Plumbing and Electrical Systems

Thoroughly inspecting the plumbing and electrical systems is crucial before purchasing a home. These are often expensive to repair or replace, so identifying potential issues upfront is essential.

Plumbing

Look for signs of leaks, water damage, low water pressure, and proper drainage. Check faucets, toilets, showers, and sinks. Don’t forget to inspect the water heater for age and functionality.

Electrical

Inspect the electrical panel for any signs of damage, outdated wiring, or improper grounding. Test outlets and light switches throughout the house to ensure they are working correctly. Consider the number of outlets and their placement for modern needs.

Look Out for Pest Issues

A pest infestation can be a costly and frustrating problem to deal with. Thoroughly inspect the property for signs of pests, such as droppings, nests, or damage. Look for evidence of termites, rodents, insects, and other unwanted critters. Pay close attention to areas like the basement, attic, and crawl spaces.

Consider a professional pest inspection. A qualified inspector can identify potential issues you might miss and provide valuable insights into the extent of any infestations. This inspection can give you peace of mind or provide leverage for negotiating repairs or price adjustments with the seller.

Review Property History and Documents

A crucial step in home buying is thoroughly reviewing the property’s history and related documents. This due diligence can reveal potential issues and protect you from future problems.

Title Search: A title search is essential to confirm the seller’s legal ownership and identify any liens, easements, or encumbrances on the property. Unresolved issues could affect your ability to secure financing or sell the property later.

Property Deeds: Examining property deeds helps trace ownership history and identify potential boundary disputes or unresolved legal matters.

Property Taxes: Verify that property taxes are current. Unpaid taxes can become your responsibility after the sale.

Understand Local Market Prices

Before committing to a purchase, gain a thorough understanding of local market prices. This knowledge is crucial for making informed offers and avoiding overpaying. Research recent sales of comparable properties in the area. Consider factors like property size, features, and location.

Analyzing market trends is also important. Is the market appreciating, depreciating, or stable? This information can impact your negotiating position. Consulting with a real estate professional can provide valuable insights into current market conditions and help you determine a fair price for your desired home.

Analyze Potential Renovation Costs

Before finalizing a home purchase, factor in potential renovation expenses. Inspect the property for necessary repairs and upgrades. Consider the condition of the roof, plumbing, electrical systems, and HVAC.

Budget appropriately for these potential costs. Obtain estimates from contractors for major renovations. This due diligence will prevent financial surprises after purchasing the property. Prioritize essential repairs over cosmetic upgrades.

Consider Future Resale Value

While you’re likely focused on finding a home that meets your current needs, it’s crucial to consider its potential resale value. A home is a significant investment, and you want to ensure you can recoup your costs, and ideally make a profit, when you eventually decide to sell.

Factors influencing resale value include location, local market trends, and the property’s condition. Look for homes in desirable neighborhoods with good schools and amenities. Research recent sales data to understand property value appreciation in the area. Finally, consider the cost of potential repairs or renovations that may be necessary to enhance its appeal to future buyers.

Assess Neighborhood Amenities

Beyond the house itself, the surrounding neighborhood plays a crucial role in your quality of life. Proximity to essential amenities is a key factor to consider.

Think about your daily needs and lifestyle. How close are grocery stores, pharmacies, and medical facilities? Consider your commute. Is the location convenient for public transportation or main roads? If you have children, research the quality of local schools and the availability of parks and recreational areas.

Investigate the presence of restaurants, entertainment venues, and other places you frequent. Evaluate the neighborhood’s safety and overall atmosphere. Does it align with your preferred lifestyle?

Secure a Professional Inspection

A professional home inspection is a crucial step in the home-buying process. It provides an unbiased, expert assessment of the property’s condition.

A qualified inspector will thoroughly examine the home’s major systems, including the roof, foundation, plumbing, electrical, heating, and cooling. They’ll identify existing problems and potential future issues. This information empowers you to make informed decisions about your purchase.

The inspection report provides a detailed account of their findings. Use this report to negotiate repairs with the seller or to reconsider the purchase entirely if significant problems are discovered.